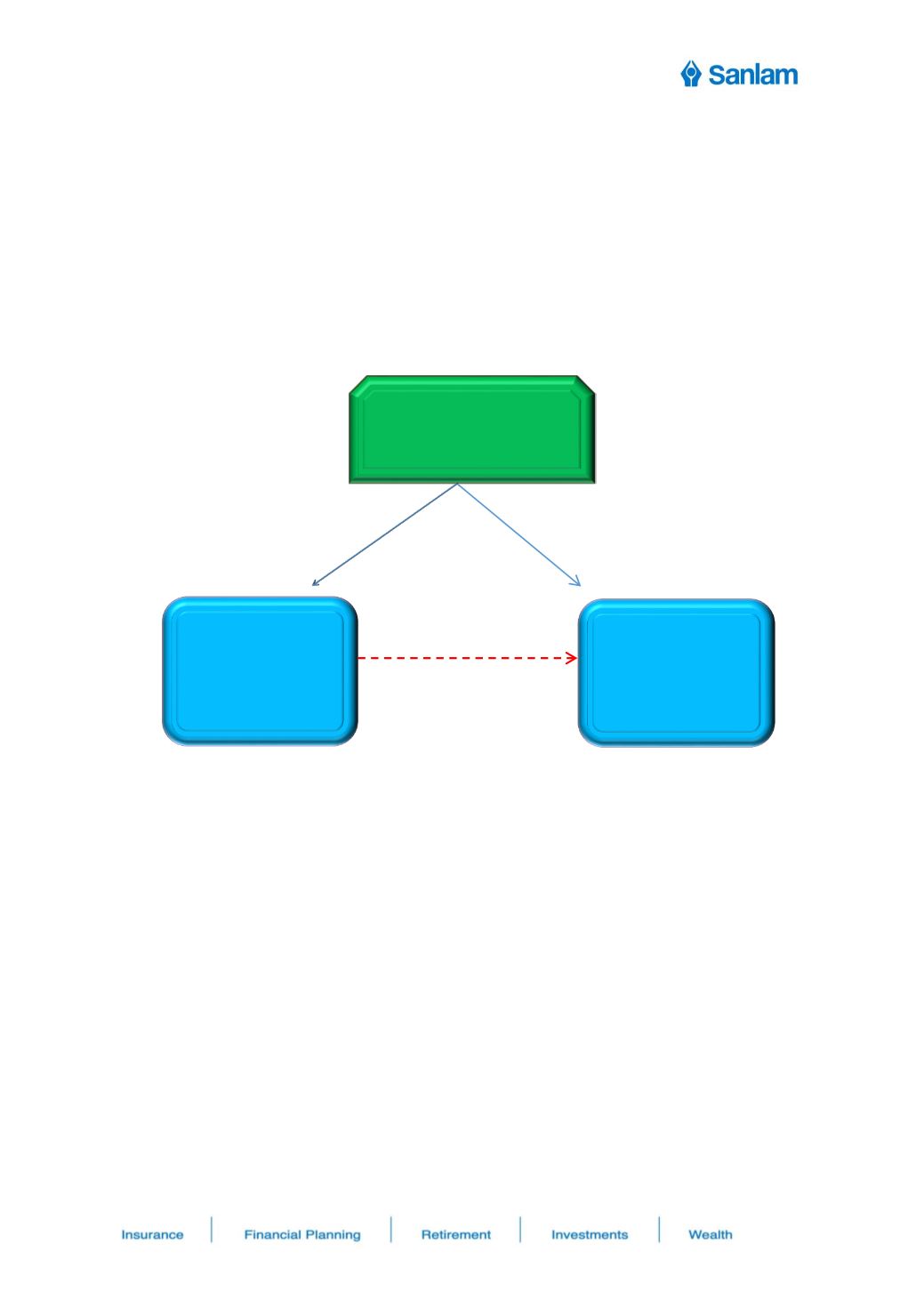

Examples:

1. Peter and Joan are married in community of property with a joint estate of R600,000. Peter

and Joan do not have any children. Peter dies without a valid will. According to the rules

of intestate succession Joan will inherit Peter’s whole estate.

Peters estate is calculated as follows (remember that they are married in community of

property so Peter only owns half of the joint estate):

R600,000 * 50% = R300,000. (Joan is entitled to her 50% of the joint property (R300,000)

and she will inherit Peter’s estate (R300,000).

50%

50%

Joan

(R300 000) +

R300 000

=

R600 000

Peter

(R300 000)

Joint Estate

R600 000

R300 000