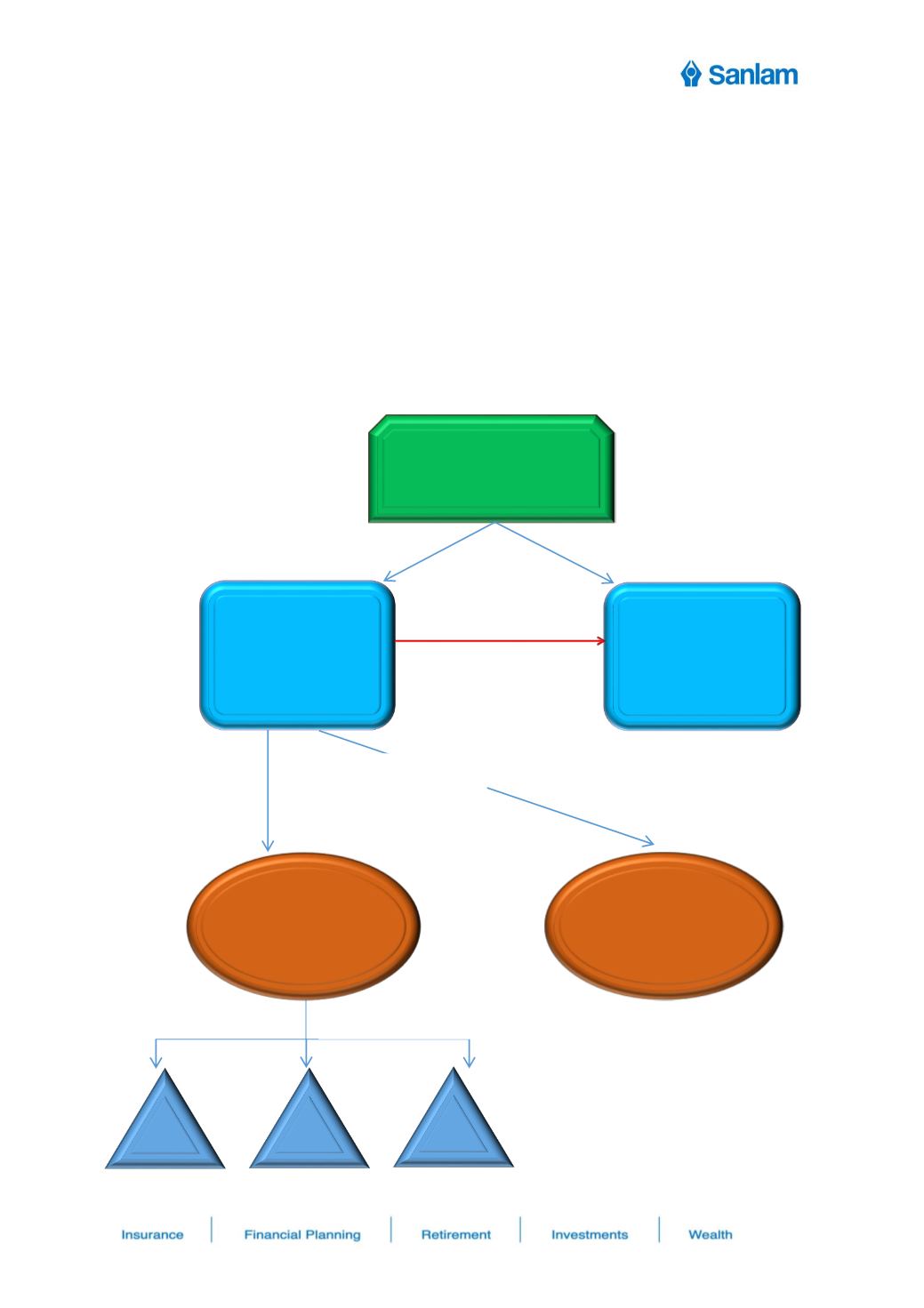

3. Peter and Joan had two children, Jack and Jill. Peter is survived by Joan, Jack and three

grandchildren of his predeceased daughter Jill. Calculate how much each person receives

at Peters death.

Peter’s estate: R600,000 * 50% = R300,000

Peter’s estate will be divided by 3 people namely Joan, Jack and Jill (her children will

receive her share)

R300,000/3 = R100,000 but Joan receives the greater of R250,000 and R100,000.

Joan therefore receives = R250,000.

The remainder: R300,000 – R250,000 = R50,000 is divided by 2 people, Jack and Jill.

Jack will receive R25 000 whilst each grandchild will receive R8 333 (R25 000/3

Greater of R250 000

& R300 000/3 =

R100 000

Remainder: R50 000

Split equally bet Jack

and Jill

Daughter:

Jill

Son:

Jack

R25 000

50%

50%

Joan

(R300 000) +

R250 000 =

R550 000

Peter

(R300 000)

Joint Estate

R600 000

C1

C2

C3

R8 333 per child